Opinion: Taking personal finance should be a state required class

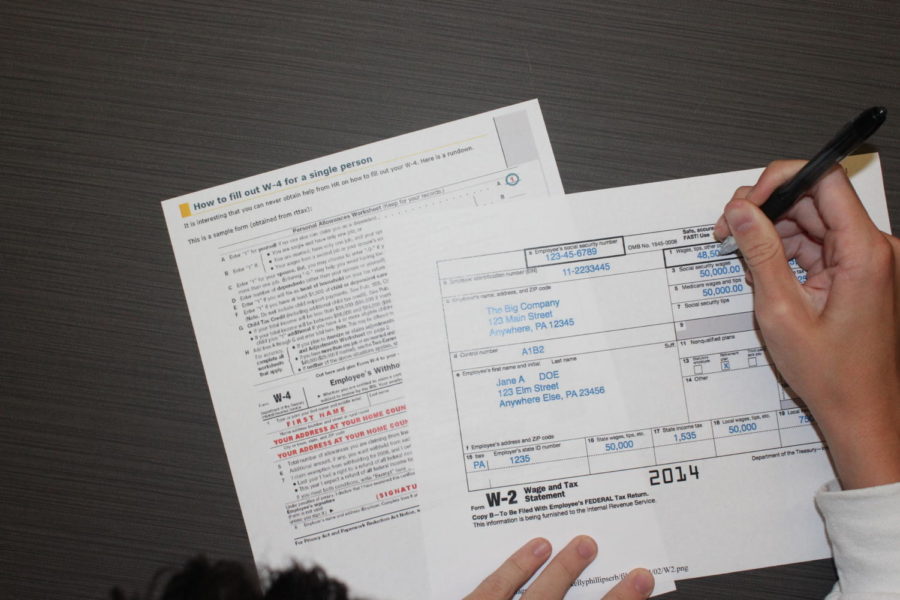

A Grand Haven High School student fills out a replica W-2 and W-4 form for Personal Finance class.

Going into my final school year at Grand Haven, I’d always thought that taking Personal Finance was somewhat of a joke – no offense Mr. Smaka or Mr. Williams – but the rumor from class to class was that it was an easy math credit that appealed to colleges a little bit more than the Math & Games route.

Thus, when I needed a one-semester class to be the final piece to my high school schedule, I went with Personal Finance.

Now, only being a handful of weeks into school, I realized that I lucked out on taking Personal Finance. It might just be the most important class on my schedule, and that means something going up against the likes of four AP classes and another that I’m a Co-Editor in Chief for.

I recognize what I said is a bold claim to be making and many might not buy it, but it’s a class that will support what lies ahead, past these cinder block walls and for the years after high school.

Think of this – other subjects give you the opportunity to receive credit for college, in certain circumstances; however, few to none can prepare and teach you for a lifetime.

And that’s one of the points I believe is so crucial.

The long-term impact that this class provides for an individual is what makes me believe that high school students should not just have the option, but be required, to take this course.

Featuring countless areas that could directly influence your standard of living down the road and how to address them now and then, Personal Finance is really summed up by the broad concept of having a plan for self-success and finding your specific needs.

“What we have now, with a required economics class that is based on the U.S. and macro-economics, is the big picture accounting,” Personal Finance teacher Aaron Smaka said. “We don’t have anything required to be taken at the individual level when it comes to those same terms.”

Making students go through the motions of possible scenarios in their near financial future in a required Personal Finance class is almost essential to forming a path to a better life, both in level of quality and financial well-being, over time.

I could be taking a shot-in-the-dark here, but I am guessing you readers strive for that too.

If I’m blunt, this thought of making this class required could also be based on the thought of my future family and the life I want to live. As of those of us who are sane-minded, we don’t want to live in debt and we want to succeed financially. With a mentality like that, one should know the basics of loans and when payments should be made and everything in between those parts of a budget.

May I ask, do you know the fundamentals to these core financial pillars?

It’s okay. Most don’t.

According to an article from Moneytips.com, around “17.8 percent of US students” who had taken a recent test put out by the Program for International Student Assessment, or PISA were considered low performers, not meeting the mark for the basic financial knowledge a teen should know.

As quoted from that piece, “proper financial education is critical for decision-making skills that drive the economy on both a personal and macro-level.”

In basic terms, this isn’t something to waste a couple hours aimlessly talking about with mom and pop, knowing that you’d want to be anywhere else but in that conversation. It takes skilled teachers, a specific curriculum that’s made for you and most importantly, time.

If someone was to tell you that your life may very well depend on this information, would you learn that topic the right way? Pretty easy answer.

All in all, it’s a pretty clear-cut call for me and I hope you too can see the same. You have the opportunity to prevent yourself from getting into financial trouble that you might not know how to get out of.

You never know how one thing can go a long way.

Senior Chris Hudson is in his last rodeo at Grand Haven High School and unfortunately, his last go with the Bucs’ Blade, this time as Editor-In-Chief....

Senior Carlos Rappleye is in the midst of his second year on The Bucs’ Blade staff. As the photo editor, he hopes to continue the quality of photography...